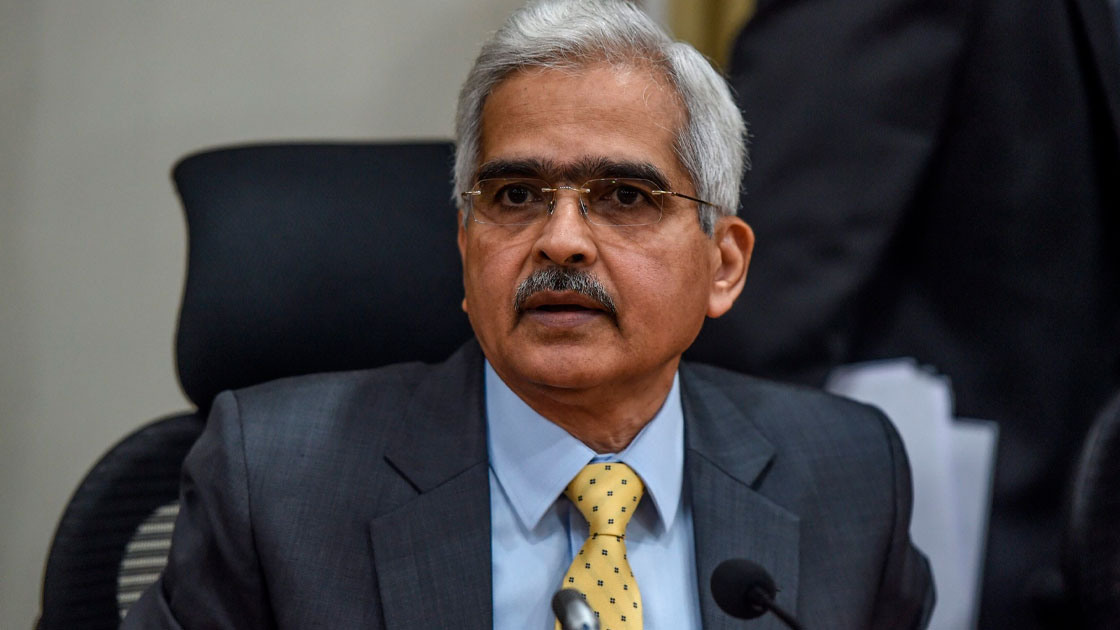

Private cryptos pose a “huge threat” to macroeconomic and financial stability, and investors should be aware of all the risks. That was stated by the head of the Reserve Bank of India (RBI) Shaktikanta Das.

In his opinion, private digital assets could undermine the RBI's ability to maintain financial stability. The manager stated that cryptocurrencies have no value, referring to "tulip mania”.

“Investors should remember that they are investing at their own risk,” Das said.

In 2018, well-known cryptographer and smart contract pioneer Nick Szabo called a label like “bubble” or “tulip mania” applied to Bitcoin by some experts and analysts as a popular cliché.

Trending: Dubai World Trade Center To Become a Crypto Hub and Regulator

Later, among them was the investment director of Guggenheim Partners Scott Minerd. In May 2021, he called cryptocurrencies a bubble, comparing the current market situation with “tulip mania”.

The statement by the head of the RBI came after Indian Finance Minister Nirmala Sitharaman announced the authorities' plans to introduce a 30% tax on income from operations with digital assets ahead of the launch of the CBDC.

The Reserve Bank of India may pilot a digital rupee in the first quarter of fiscal 2022.

Recall that at the beginning of 2021 in India, they announced a possible legislative ban on cryptocurrencies, it even came up with criminal liability for owners.

Trending: Google's Parent Company Alphabet Is the Leader in Crypto Investments

In the middle of the year, information appeared that the authorities were legalizing digital currencies as an asset class.

However, in November, there was renewed talk of the government's intention to ban most "private currencies." This caused a panic in the local market, which led to a short-term local drop in the price of bitcoin by 15%.