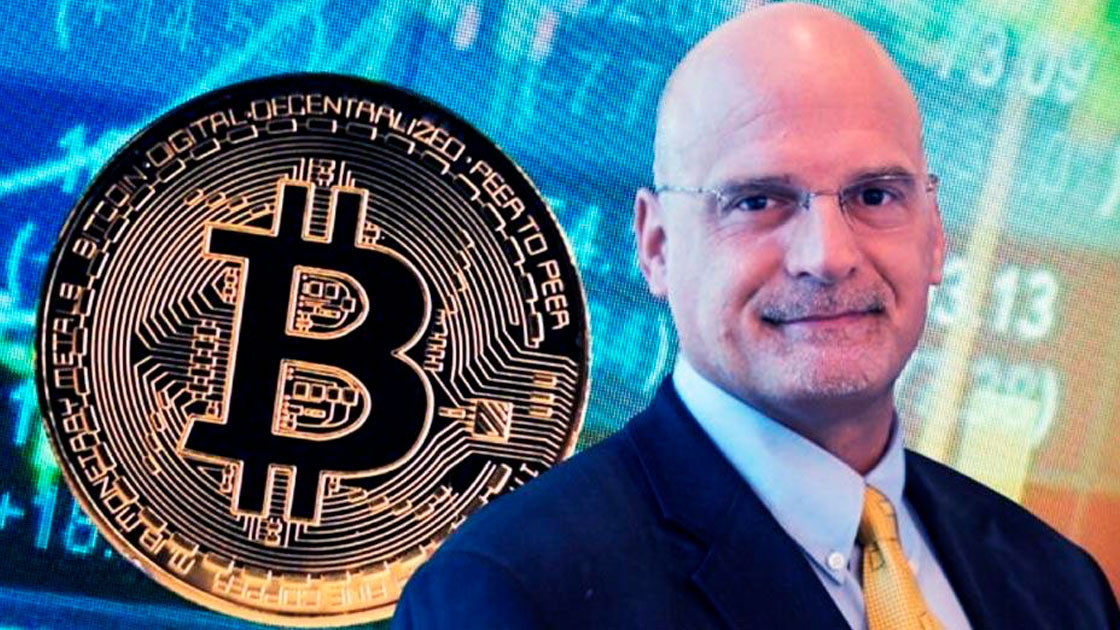

Bloomberg strategist Mike McGlone commented on the fall of the stock market and digital currencies. In his opinion, the trend we observe is a direct result of the tightening of the monetary policy of the US Federal Reserve System.

The expert expressed his position in an interview with Yahoo Finance.

Recall that Mike McGlone is known for predicting a repeat of the famous bitcoin run and reaching $20,000 in the summer of 2020. Moreover, the same analyst did not rule out a more impressive performance of BTC.

Trending: German Digital Bank N26 Launches Crypto Trading

According to McGlone, the tightening of the monetary rate of the Fed in the long term will help improve the position of the cryptocurrency.

The stock market is likely to retreat in the coming months. Bitcoin and ether will also fall in value, but they will not only be able to win back losses but also outperform other assets in terms of profitability.

The Bloomberg strategist echoes the point of view of those experts who see similarities between BTC and shares of the giant Amazon in the early 2000s. The company also experienced capital outflows during a period of volatility in 2009, which is exactly what we are seeing around bitcoin now, McGlone said.