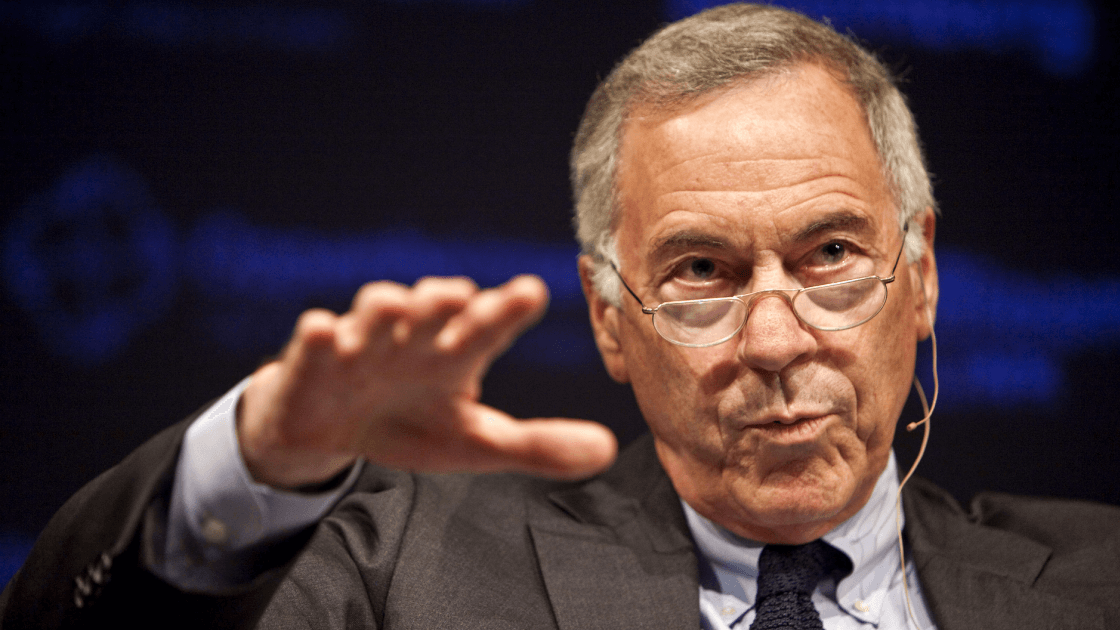

The number of opponents of Bitcoin continues to increase, recently they are joined by Professor of Economics at Johns Hopkins University Steve Hanke.

He recently called BTC on a Twitter tool for speculators. The economist emphasized that Bitcoin cannot be called a currency. For a coin to be universally recognized, it must be tied to real assets.

#Bitcoin is a highly speculative asset, not a currency. #Cryptocurrencies must be tied to a basket of commodities in order to be considered a legitimate currency. https://t.co/D920f9vazx

— Prof. Steve Hanke (@steve_hanke) June 22, 2020

The expert in this regard compared bitcoin with those national currencies that are tied to a basket of goods.

Trending: Dubai World Trade Center To Become a Crypto Hub and Regulator

For example, the Australian dollar is tied to the cost of iron ore - one of Australia's central export commodities. Accordingly, the national currency rate is changing taking into account the dynamics of demand for the underlying commodity asset. The Canadian dollar depends on the price of oil produced by the country.

If we take the methodology of evaluating Steve Hancock as a basis, it turns out that bitcoin really does not have real security. However, observers note that over the past 11 years, many have repeatedly called cryptocurrency a “bubble” and announced its imminent collapse.

However, BTC not only remains on the market but is also gaining new supporters, as evidenced by the increase in the number of bitcoin addresses.