While the arrival of institutional interest is one of the most cited reasons by cryptocurrency enthusiasts for this year’s rally, the head of the world’s largest online exchange says private investors are still playing a key role in driving the dramatic price gains.

Related: Binance CEO: More governments will adopt crypto in 2020

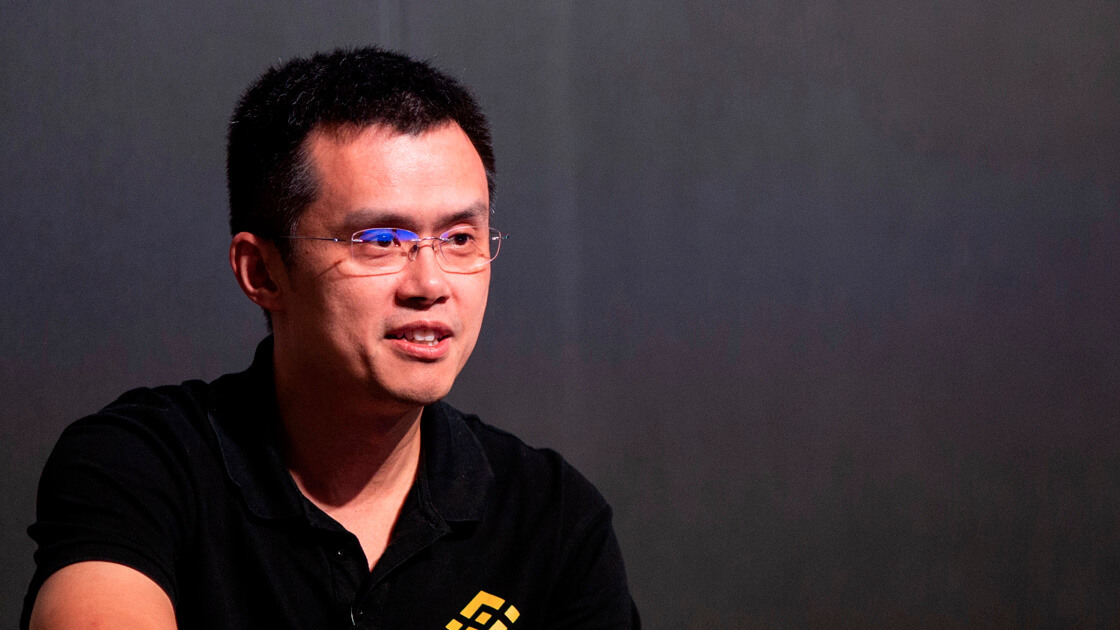

The CEO of Binance, Zhao Changpeng said they haven’t seen institutions growing faster. What they’ve seen is a pickup in both places. The number of institutions coming into this industry has not raised that largely in 2019 yet.

While both institutional and retail trading is increasing at Binance, individual investors account for about 60% of trading volume -- about the same percentage as last year, Zhao noticed. That is even as companies like Facebook Inc. and JPMorgan Chase & Co. have announced major digital coin efforts, which are expected to push more corporations and funds to give cryptocurrencies a closer look.

This growth comes in part thanks to greater availability of margin trading. On July 11, Binance began allowing all traders to borrow up to three times the amount of money they put down, and 10,000 traders signed up on the first day, borrowing $15 million in funds. Another large exchange, Bitfinex, recently allowed traders to borrow up to 100 times their deposits on certain products. Armed with more funds to speculate with, traders have driven Bitcoin’s price up 36% since the beginning of June.